33+ deducting home mortgage interest

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. It is particularly revered in Los Angeles and.

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

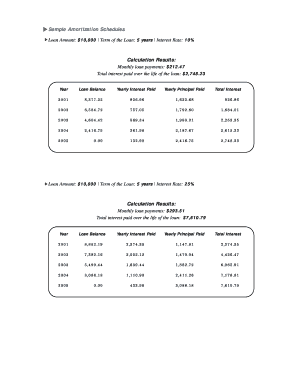

Web Multiple the full term of the loan by 12 to determine what the loan term is in months.

. Web Taxpayers who took out a mortgage after Dec. You may still be able to. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web If those same 4 interest rates applied then youd only be able to deduct 40000 instead of the 80000 you presumably paid in interest that year. 30 x 12 360.

15 2017 can deduct only the interest paid on up to 750000 or 375000 for married couples filing separately. Web Enter your address and answer a few questions to get started. For taxpayers who use.

If you go into the forms and look at the worksheets adding the date the loan was paid off in 2022 and. Web After Congress passed the Tax Cuts and Jobs Act of 2017 TCJA the number of US. Ad Discover All The Advantages Of A Reverse Mortgage Loan And Decide If One Is Right For You.

Web If your home was purchased before Dec. Web For decades the home mortgage interest deduction has been one of the most sacred of cows in the US. Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today.

Web Deductible mortgage interest is interest you pay on a loan secured by a main home or second home that was used to buy build or substantially improve the. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Web Under his bill AB1905 about 175000 taxpayers would lose their mortgage interest deduction for second homes and owe approximately 1000 more on their.

Web IRS Publication 936. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today.

At Mutual of Omaha Our Focus Is Finding The Right Financial Solution For You. Even if you didnt get your home mortgage interest deduction on Schedule A because you didnt have enough itemized deductions to exceed your standard. Web The Mortgage Credit Certificate MCC program allows qualified homebuyers to claim a tax credit on their federal income tax returns equal to 10 to 50 of the.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. This deduction is capped at 10000 Zimmelman says. Web You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year.

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. 750000 if the loan was finalized after Dec. Web Todays mortgage rates in California are 6494 for a 30-year fixed 5797 for a 15-year fixed and 6689 for a 5-year adjustable-rate mortgage ARM.

Households claiming the home mortgage interest deduction declined. Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Homeowners who bought houses before.

Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. Getting ready to buy a. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

So if you were dutifully. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Divide the cost of the points paid by the full term of the loan in.

It seems to be broken again for 2022 tax year.

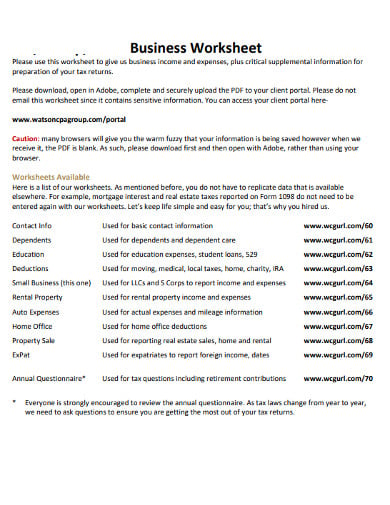

12 Business Expenses Worksheet In Pdf Doc

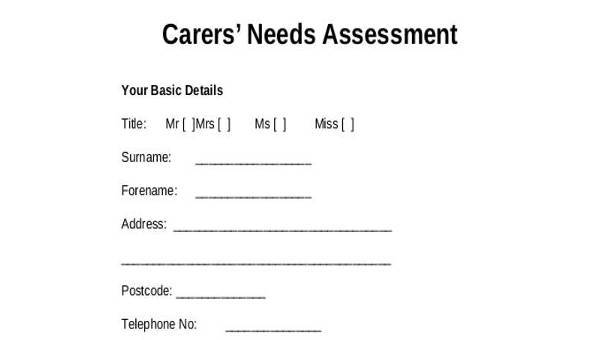

Free 33 Sample Free Assessment Forms In Ms Word Pdf Excel

Mortgage Interest Deduction What You Need To Know Mortgage Professional

33 Free Editable Amortization Schedule Templates In Ms Word Doc Pdffiller

5 Year Fixed Mortgage Rates And Loan Programs

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Home Mortgage Tax Deduction Justia

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

A Guide To Mortgage Interest Deduction Quicken Loans

Will The New Tax Law Affect My Mortgage Interest Deduction San Diego Mortgage Broker San Diego Home Loans

33 Most Flexible Part Time Jobs For Your Schedule

5 Documents You Need To Save Cash At Tax Time Tips For Home Buyers Tax Time Real Estate Tips Tax

Annual Report 2003 2004

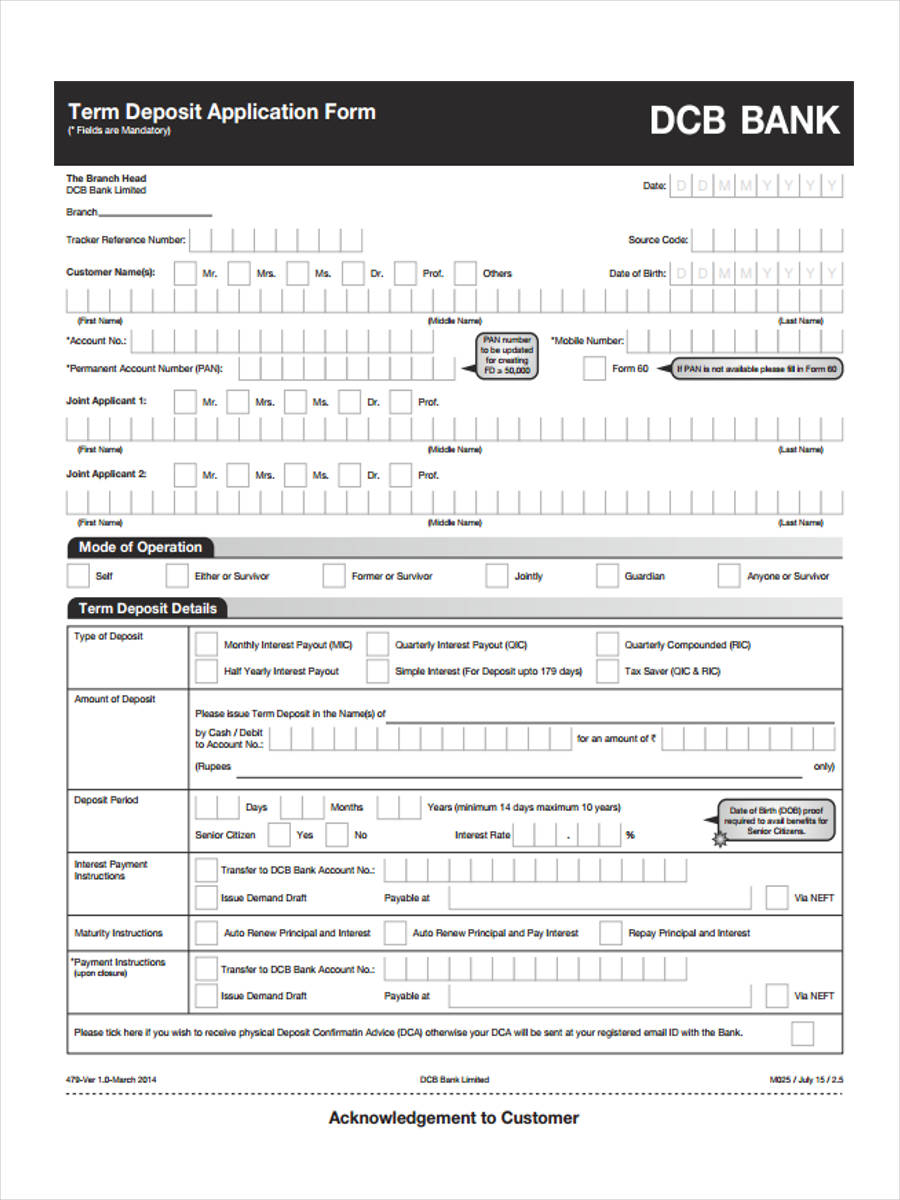

Free 33 Deposit Forms In Pdf Ms Word

Open Esds

Mortgage Interest Deduction Bankrate

Tarun K Ray On Twitter Do You Have A Requirement Of Loan Or Credit Card Contact Us Now Email Us Info Sroyps Com Ring 0 91270 66444 Personal Loan Pl Business Loan Bl Bt Top